Revolut Review 2025: The Ultimate Guide to Multi-Currency Banking, Crypto, and Global Finance

If you're searching for modern financial solution that supports both traditional banking and cryptocurrency needs, Revolut stands out in 2025. With its expansive features, competitive fees, and user-friendly interface, Revolut has become a go-to platform for individuals and businesses alike.

🌍 Multi-Currency Accounts & Global Transfers

Revolut offers multi-currency accounts, allowing users to hold and exchange over 30 currencies. This feature is specially beneficial for travelers, freelancers, digital nomads, and businesses dealing with international clients. Transfers between Revolut users are instant and free, making global transactions seamless.

💳 Transparent Fee Structure

Revolut's tiered plans cater to various user needs:

- Standard Plan: No monthly fee, with free ATM withdrawals up to €200 per month; a 2% fee applies.

- Premium & Metal Plans: Higher withdrawal limits, free international transfers, and perks like travel insurance and airport lounge access.

- Ultra Plan (New in 2025): Designed for high-net-worth users with extensive concierge services and investing tools.

Currency exchange is free up to certain limits, with a 0.5% fair usage fee beyond that. Weekend markups may apply during volatile hours.

🔐 Robust Security Measures

Security is paramount with Revolut. Features include:

- Fast card freezing and unfreezing

- Disposable virtual cards for one-time use

- Advanced fraud detection systems

- Push notification for every transaction

In 2025, Revolut upgraded its systems with enhanced crypto fraud prevention tools to reduce phishing attacks and fake wallet scams.

Ledger Cryptocurrency Wallet

📈 Cryptocurrency Integration

Revolut has significantly expanded its cryptocurrency offerings:

- Trading: Buy, sell, and hold over 200 cryptocurrencies within the app.

- Revolut X: A separate crypto trading platform launched for UK and EU users.

- Stablecoin: Plans to launch a proprietary stablecoin to rival Tether and USDC.

- Withdrawals: Users can now transfer crypto to external wallets like Ledger.

This makes Revolut a hybrid financial tool that caters to both fiat and crypto users.

🏦 Business Banking Solutions

Revolut Business accounts provide features for SMEs, freelancers, and large enterprises:

- Hold and exchange in 34 currencies

- Receive local account details for GBP, EUR, and USD

- Set team spending limits and issue multiple employee cards

- Integrate with tools like Slack, Xero, and QuickBooks

This makes Revolut an excellent choice for borderless business management.

🔍 Who Is Revolut Best For?

- Freelancers: Send and receive global payments without high FX fees

- Travelers: Spend abroad at interbank rates with no hidden fees

- Crypto Enthusiasts: Buy, sell, and send crypto with minimal friction

- Students & Expats: Manage money between countries easily

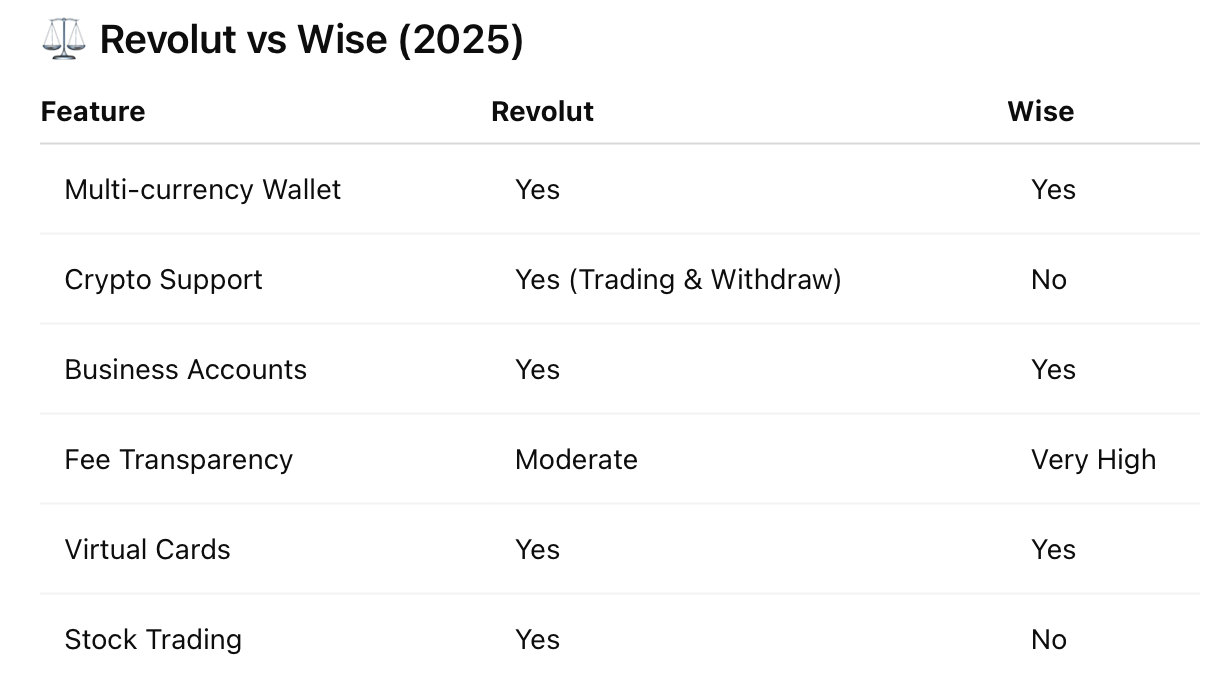

Wise is excellent for pure money transfer and fee transparency, while Revolut shines in versatility and crypto integration.

❌ Pros and Cons of Revolut

Pros:

- Supports 30+ currencies and 200+ crypto coins

- Real-time transaction notifications

- Crypto withdrawals now available

- Cashback, rewards, and insurance with higher plans

Cons:

- Weekend FX markups apply

- Customer support can be slow on lower-tier plans

- Crypto fees can be higher compared to dedicated exchanges

Signing up for Revolut using my link not only gives you access to their powerful features — it also helps support my blog at no cost to you.

To make sure I receive the €40 affiliate reward, here’s what you need to do:

✅ Quick Steps to Make Your Signup Count:

- Sign up using my link

Download the app and create your free account through this link. Make sure you complete the identity verification (KYC) step. - Top up your account

Add money using your debit card or a bank transfer. This shows Revolut you’re an active user. - Order your physical card

It only takes a few taps in the app. You can also add it to Apple Pay or Google Pay to start using it instantly for contactless payments. - Make 3 separate purchases

Just make three purchases of at least €5 each using your Revolut card (physical or digital). That’s it!

🔐 All of this happens securely through the Revolut app. No extra fees. No catch.

🤔 Frequently Asked Questions (FAQs)

Q: Can I use Revolut for free? A: Yes, the Standard plan is free with basic features and capped ATM withdrawals.

Q: Does Revolut support crypto withdrawals? A: Yes, as of 2025, Revolut supports withdrawals to personal wallets like Zengo.

Q: Is Revolut safe? A: Yes, it is regulated in multiple jurisdictions and uses advanced security protocols.

Q: Can I use Revolut as a student or traveler? A: Absolutely. It’s ideal for managing foreign exchange and budgeting on the go.

🚀 Final Verdict

Revolut in 2025 offers one of the most powerful and complete financial ecosystems in the digital banking space. Whether you're a solo traveler, digital entrepreneur, or crypto investor, Revolut provides you with tools that rival both traditional banks and fintech startups.

If you're ready to explore smarter banking, sign up for Revolut today using our affiliate link and experience the future of finance.

Disclaimer: This article contains affiliate links. If you sign up through them, we may earn a commission at no extra cost to you.